- Home

- Worldwide

- Our regional offices

- Continental Southeast Asia

- News : Continental Southeast Asia

- Seminar Carbon Markets Green Finance Agricultural Transition Southeast Asia

Seminar Exploring Carbon Markets and Green Finance for Agricultural Transition in Southeast Asia

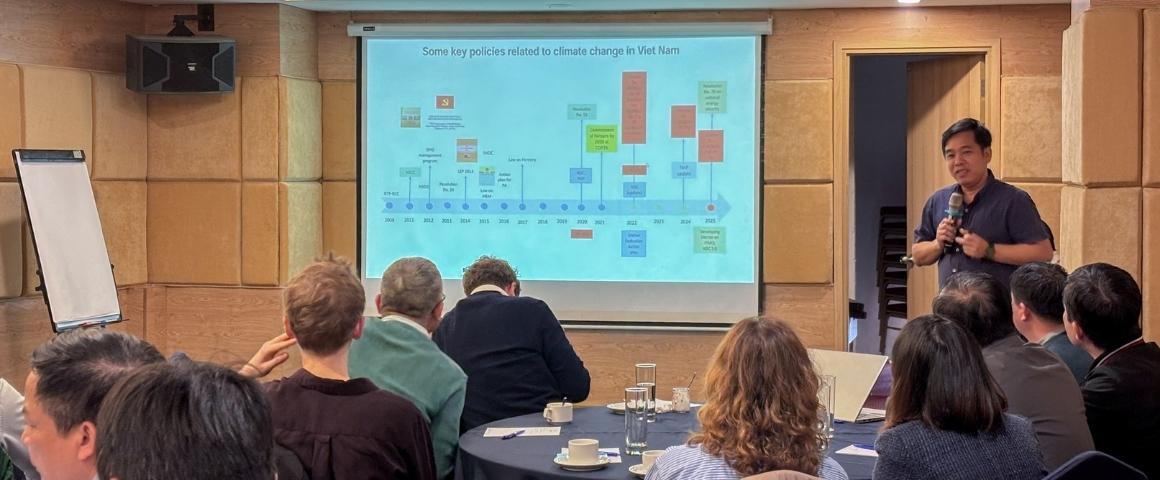

The CIRAD team, under the ASSET project, organized a technical seminar on carbon credits and green finance © L. Vo, CIRAD

On 15 January 2026, CIRAD held a technical seminar in Hanoi, Vietnam, as part of the ASSET project. The event brought together researchers, officials from Vietnam and Cambodia, and technical experts in carbon finance and agricultural development. As Southeast Asian countries work to meet their climate commitments under the Paris Agreement, agriculture is now included in their plans to reduce emissions. The seminar examined how carbon market systems and related financial tools are being set up and used in Vietnam and Cambodia.

Carbon Markets in Context

Under the Paris Agreement, countries submit Nationally Determined Contributions (NDCs), often distinguishing between emission reductions they can achieve with domestic resources and those that depend on external support. In many Southeast Asian countries, this conditional component underscores the need to mobilise additional finance.

The seminar presented carbon markets as one tool among many in climate finance. Both regulated and voluntary market approaches were discussed, focusing on how to finance and track emission reductions. The Paris Agreement, especially international cooperation under Article 6, sets the framework for these market systems.

In this context, agricultural projects to reduce emissions are increasingly being considered as a way to help meet national climate goals.

Carbon markets turn emission reductions into tradable credits. Companies and other organizations buy these credits to help cover some of their greenhouse gas emissions. In regulated (compliance) systems, credits are traded under government oversight; in voluntary markets, companies buy credits to meet their own climate goals. All projects must show measurable reductions through monitoring, reporting, and verification (MRV). Credits can come from a company’s own supply chain (insetting) or from outside projects (offsetting).

Agriculture in National Climate Strategies

A main focus of the seminar was how agriculture fits into national plans to cut emissions. Dr. Florent Tivet, CIRAD, explained that rice farming remains a major source of methane emissions in Southeast Asia, and that fertilizer use also contributes to nitrous oxide emissions. He also pointed out that changes in water management, soil practices, and land use, like alternate wetting and drying in rice fields, agroforestry, and soil carbon projects, can help reduce emissions. As these practices are increasingly linked to carbon finance mechanisms, representatives from Vietnam and Cambodia outlined how agriculture is being incorporated into their respective carbon market developments.

Vietnam: Structuring a Domestic Carbon Market

Vietnam’s work with carbon markets is based on its earlier experience with the Clean Development Mechanism (CDM). In the past, hydropower, solar, and wind energy projects generated emission credits for international buyers. This technical experience is now helping Vietnam develop its own carbon market system.

At the seminar, Dr. Nguyen Sy Linh described new regulations that are preparing the way for a national emissions trading system and setting rules for the use of carbon credits in compliance programs. He also discussed the government’s low-emission rice program in the Mekong Delta, which links changes in farming to climate policy. “According to preliminary estimates, one hectare of rice production under the low-emission programme can reduce between 2.6 and 8 tons of carbon per season,” he noted.

As Vietnam shifts from individual projects to building a full carbon market, key questions remain about how to put the system in place, whether there will be enough demand, and how to ensure reliable accounting.

Cambodia: Expanding Carbon Farming Initiatives

Presenting the Cambodian perspective, Vira Leng, the General Directorate of Agriculture (GDA), described pilot projects in rice and agroforestry that aim to translate changes in farming practices into measurable reductions in emissions. These initiatives operate largely within voluntary carbon markets, where credits are generated and certified in accordance with international standards.

The discussion showed that many new groups are joining Cambodia’s carbon ecosystem, such as project developers, verifiers, and registries. Speakers also pointed out some practical issues. Monitoring, reporting, and verification (MRV) processes are costly, and carbon revenues are shared among several intermediaries before reaching farmers. Questions about setting baselines, proving additionality, and managing land over the long term were also raised as important for credibility.

While carbon finance can provide extra income, it was described as just one part of wider efforts to support changes in agriculture and rural development.

Carbon Markets Within Broader Green Finance

Carbon credit is not the objective, but it’s just a tool to support the farmer for the transition.

Besides carbon credit mechanisms, participants also discussed other tools like green lending, ESG-linked financing, and blended finance. While carbon revenues can encourage changes in farming, their impact depends on credible methodologies, clear accounting, and strong regulations. To fit these tools into national climate strategies, public institutions, private groups, and international partners need to work together.

In both Vietnam and Cambodia, building carbon market systems is closely tied to wider agricultural and institutional reforms. As countries move forward with their climate commitments, carbon markets can provide additional resources and structure for reducing emissions, but they cannot replace ongoing policy work and investment in agriculture.